Elizabeth Steiner says she supports reducing state pension fund investment in the underperforming assets.

By James Neff

Oregon Journalism Project

In an unusual public letter to the Oregon Investment Council last week, State Treasurer Elizabeth Steiner said she supports trimming $6 billion in private equity assets from the Oregon Public Employees Retirement Fund.

“While it is true that private equity has added significant value to our funds, I agree with the OIC and staff’s decision to reduce our overall allocation in this asset class,” she wrote.

Steiner’s letter signals a concession to critics and a significant shift in how state officials invest the $100 billion retirement contributions of 415,000 current and retired public employees.

An OJP investigation published in August found the state pension fund had underperformed for years, mostly due to not having enough money in the stock market and having too much in private equity.

These risky, secretive private investments have underperformed their benchmark over the past decade and dragged down OPERF’s overall returns. As a result, cities and school districts have been forced to pay millions more for their workers’ pension benefits, which now cost 27 cents for every payroll dollar. To pay for the rate hikes, public officials have had to lay off teachers, police, and other public employees.

These risky, secretive private investments have underperformed their benchmark over the past decade and dragged down OPERF’s overall returns. As a result, cities and school districts have been forced to pay millions more for their workers’ pension benefits, which now cost 27 cents for every payroll dollar. To pay for the rate hikes, public officials have had to lay off teachers, police, and other public employees.

The significance of that shift is that Steiner, who took office in January, is acknowledging the impact of private equity investment’s poor performance.

“I am open to shifting allocations in the future,” she also wrote, suggesting an allocation lower than 20%. As treasurer, she is one of five voting members of the Oregon Investment Council. The others are volunteers appointed by the governor.

Cara Samples, chair of the Oregon Investment Council, said in an interview she was “super-appreciative” of Steiner’s transparency. “It benefits everyone to know what her beliefs and principles and priorities are.” Steiner’s letter was not on the OIC agenda or discussed at its recent meeting.

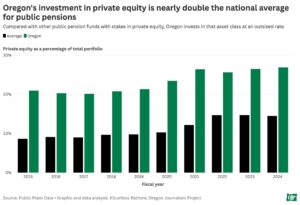

Previously, Steiner has said looking at a short span of past performance is misleading because OPERF invests over decades, not just several years. As a lawmaker and when she ran for treasurer last year, she declined to criticize the Oregon State Treasury’s private equity performance, at least publicly. By July 2024, it had swelled to 28.4% of OPERF’s portfolio, far above its agreed upon target of 20%. The overweight position was also above the private equity range approved by the OIC: 17.5% to 27.5%.

Private equity now makes up 26% of the pensioners’ portfolio. Steiner said she supports the investment council plan to reduce it to 20% by the end of 2028.

The median private equity allocation for state public pensions is 15%.

Private equity firms devote themselves to making profits from highly leveraged investments in private companies using money from public pension funds, foundations, and wealthy investors. The firms, such as Apollo, Blackstone, KKR and thousands of others, face little public disclosure or regulation, and charge lucrative fees: typically 2% a year and 20% of any profits.

Steiner’s shift mirrors concerns expressed privately by her predecessor as treasurer, now Secretary of State Tobias Read.

Publicly, Read had supported the treasury’s private equity program. But behind the scenes, months before the end of his second four-year term in January, Read badmouthed private equity in emails to his lieutenants.

“We should be talking more about risk…and the broader private equity portfolio (I know I’ve been a broken record),” Read wrote in the emails obtained by OJP. “I worry [about]…our private equity asset class generally, which has underperformed for years now.”

For much of her first year in office, Steiner, a physician and former lawmaker, hewed to the agency’s staunch support for a large commitment of pension money to private investments.

While acknowledging the private equity portfolio needed to be slimmed down, she also said in an August interview with OJP: “We don’t want to stop making allocations in private equity because that means we lose opportunities going forward.”

Besides coverage by OJP and in The Oregonian, the treasury’s overreliance on private equity has been criticized by Divest Oregon, the state affiliate of the American Federation of Teachers, Democratic lawmakers, and other interest groups.

At last week’s OIC meeting, Steiner said she and treasury staff have felt the sting of the comments and coverage.

“Understandably, I think, both staff and council are a little more anxious because of that scrutiny,” Steiner said. “It’s hard to disaggregate our emotional response to being criticized from our work. We try, but it’s hard.”