Sean C. Morgan

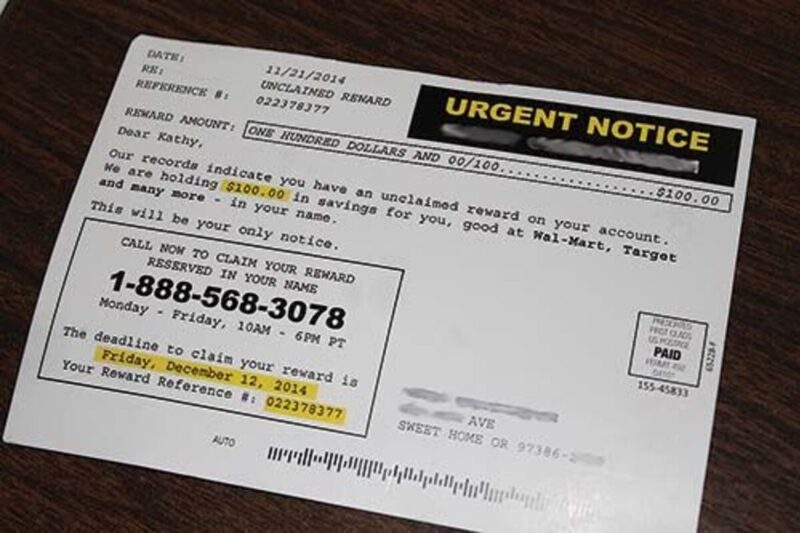

A Sweet Home woman recently received a postcard indicating she had an unclaimed prize of $100 good at Wal-Mart, Target and many other locations.

“Urgent Notice,” stamped in large type at the top, indicated time was of the essence if she wanted to claim the prize. A prominently displayed phone number beckoned the woman to call.

But her granddaughter told her it was probably just another scam. She didn’t make the call.

Was it actually a scam?

Possibly. Probably.

It’s words like “urgent” that catch Sweet Home Police Department Det. Cyndi Pichardo’s attention and make her nervous right off the bat.

“Somebody was trying to sell a ring on Craigslist,” said Sgt. Jason Ogden. The buyer sent a check for $1,500, more than the buyer was supposed to pay. The owner didn’t send the ring.

In Craigslist scams, “they’ll send the item, the check turns out to be fraudulent,” Pichardo said. The buyer may tell the seller to cash the check and send the extra back after cashing it.

It’s all designed to part the unwary from their cash.

Scams show up in email, by phone or by mail in a variety of forms; and when they work, they can pay off big for the con artist.

“They’re only limited by their imaginations, as far as these scams,” said Police Chief Jeff Lynn.

In an old-fashioned Nigerian email scam that was common a half dozen years ago, a local woman lost upward of $800,000, ultimately drawing a threat of charges from the state Department of Justice.

“She was told by multiple law enforcement officers that she was participating in a scam,” Pichardo said. DOJ officials told her to stop sending money or she would be charged in the case.

The scams can be something like gambling, Pichardo said. “These Nigerian fraud suspects are convincing, super-convincing.”

The hope of easy cash draws some of them in again.

The same victim returned to the Police Department a few weeks ago, reporting that she may be involved in another scam and that she had already sent $2,200 to Nassau, Pichardo said.

Last week, an elderly female received a phone call from a man with a thick accent, Pichardo said. He informed her she had won a small lottery and needed to pay “pre-taxes.” Her bank advised her to report it to the police.

Pichardo called the man, she said. “I ID’d myself as a police officer. He told me I wasn’t a police offier.”

Then he demanded to speak with his victim, Pichardo said. She refused, and he eventually hung up the phone.

Many of these scams require victims to act quickly.

“When people don’t have the time to think it through, they’re more likely to not to think it through,” Pichardo said. The postcard marked “Urgent Notice” would most likely lead to someone asking for personal information that is unnecessary in order to get access to bank accounts.

“You don’t get something for nothing,” Pichardo said. “If it’s too good to be true.”

Before answering unsolicited requests for information, before releasing information or funds, Pichardo urges people to contact the police or their banks about it.

An Internet search will reveal many scams too, Lynn said. “If it sounds too good, contact us, get online, do a web search.”

Last year, Pichardo said SHPD received several reports of telephone collection scams. In that type of scam, the callers already have information about the victims, which makes the calls seem legitimate. Then the con artists tells the victims they are delinquent on a bill. The call is fast-paced as the callers threaten victims with legal action.

People are sucked into pay a bill, and it’s not legitimate, Pichardo said.

In another recent scam, a local woman essentially has been transporting ill-gotten goods to Ghana.

The con artist developed an Internet relationship with the woman, Pichardo said. The scammer would use credit card fraud to purchase items, such as large-screen TVs; and he would use her to ship the property to Ghana.

At this time of year, scammers will call purporting to be with Medicare and ask would-be victims to enroll in a prescription supplement, Pichardo said. Medicare will never call and ask for personal information, though.

“I hesitate to give anyone information,” Pichardo said. If she thinks she might need to provide information, she ends the call then makes sure she contacts the actual business or agency before answering questions.

Victims of scams and identity theft should contact the police and then the Federal Trade Commission by phone or through its website, ftc.gov Pichardo said. Anyone with questions may contact Pichardo at (541) 367-5181.

Rules to remember

when using the Internet

– Do not respond to unsolicited email.

– Do not click on links contained in unsolicited email.

– Be cautious of email claiming to contain pictures in attached files. The files may contain viruses. Only open attachments from known senders. Scan the attachments for viruses.

– Avoid filling out forms asking for personal information in email in email messages.

– Always compare the link in the email to the link you are actually directed to and determine if they match and will lead you to a legitimate site.

– Log on directly to the official website for a business identified in an email instead of linking to it from an unsolicited email. If email appears to be from your bank, credit card issues or other company you deal with frequently, your statements or official correspondence from the business will provide the proper contact number.

– Contact the actual business that supposedly sent the email to verify the email is genuine.

– If you are requested to act quickly or there is an emergency that requires your attention, it may be a scam. Fraudsters create a sense of urgency to get you to act quickly.

– Remember, if it looks to good to be true, it probably is.

– Never wire money based on a request made over the phone or in an email – especially overseas. You won’t get it back.

Common Scams

– Free-grant ads claim you will qualify to receive a free grant for your education, home repairs, your home business or your unpaid bills. They say your application is guaranteed to be accepted, and you never have to repay the money.

The Federal Trade Commission warns that “money-for-nothing” grant offers often are a scam. The grant isn’t free. It isn’t guaranteed, and often, it isn’t even available to you.

– Seniors and people with disabilities should be aware of a scheme that asks Medicare beneficiaries for money and checking account information to help them enroll in a Medicare prescription drug plan.

No Medicare drug plan will ask a Medicare recipient for bank account or other personal information.

– The Social Security Administration has received several reports of an email message being circulated with the subject “Cost-of-Living for 2015 update” and purporting to be from the Social Security Administration.

Once directed to the phony website, the respondent is asked to register for a password and to confirm his or her identity by providing personal information, such as the individual’s Social Security number, bank account information and credit card information.

– Craigslist scammers often pose as potential buyers in response to sales ads and agree to purchase the item listed. They send the seller a check for money than the item is being sold for.

They ask the seller to cash the check and send back the overage. Checks normally take a few days to clear, so by the time the check is returned to your bank marked insufficient funds, the cash has already been sent to the buyer.

-Ring and Run is a scam that repeats itself in modified forms every few years. Once again, it’s spreading. Criminals target people simply by calling and hanging up. Victims receive a call on their phones from area code 473, which rings once and disconnects, thereby arousing the recipients’ natural curiosity.

Don’t call back. While the area code may appear to be domestic, it isn’t. The area code was created in the late 1990s for the islands of Grenada, Carriacou and Petite Martinique, which like the United States, use country code 1.

Calls placed to 473 numbers are international calls and can be quite expensive. Because the criminals sometimes establish the number as a premium service number, the rate can exceed $20 for the first minute.

-In telephone collection scams, a caller claims that the victim is delinquent on a payday loan or other debt and must repay the loan to avoid legal consequences. The callers purport to be representatives of the FBI, the Federal Legislative Department, various law firms or other legitimate-sounding agencies. They claim to be collecting debts for companies such as United Cash Advance, U.S. Cash Advance, U.S. Cash Net and other Internet check cashing services.

One of the most convincing aspects of the scams is that the callers have accurate information about the victims, including Social Security numbers, dates of birth, addresses, employer information, bank account numbers and names and telephone numbers of relatives and friends.

The victims often report that they had completed online applications for other loans or credit cards before the calls began.

The fraudsters relentlessly call the victim’s home, cell phone and place of employment. They refuse to provide to the victims any details of the alleged payday loans and become abusive when questioned. The callers threaten victims with legal action, arrest and in some cases, physical violence if they refuse to pay.

In many cases, the callers even resort to harassment of the victim’s relatives, friends and employers. Some fraudsters instruct victims to fax a statement agreeing to pay a certain dollar amount on a specific date via prepaid Visa card. The statement further declares that the victim would never dispute the debt.

– In “Nigerian” lottery-inheritance winner scams, con artists contact the intended victims stating the victims have won the lottery or an inheritance. The victims are directed to go to their banks and wire money in advance to pay taxes and fees associated with the winnings.

Often, the fraudsters will make the request repeatedly, claiming unexpected fees were added. Most of the time, the victims are wiring money out of the United States. When that happens, little hope remains of recovering any of the funds.

-Grandparent scams. Scammers will call or email you and identify themselves as your grandson. “He” will tell you that he’s been arrested, gotten in a car accident, or experienced some other bad situation in another country and needs money wired quickly to pay his bail.

“He” will generally caution you not to alert his parents “because I don’t want to upset them.” The scam has been around since at least 2008, according to the FBI, but social networking and internet sites have allowed scammers to get more sophisticated, as they can get more information about their targets. Often, victims lose thousands of dollars in this scam.

– Lebanon Police Department has been warning community members about a possible scam.

Several businesses in Lebanon have received phone calls from a Sports Media Company asking for funds to support a sports calendar for Lebanon High School. At this time, there is no sports calendar in the works for Lebanon schools, and no one should be asking for funds for this.

– With tax season, con artists are stealing Social Security numbers to file for fraudulent tax refunds. To date, the IRS has identified 15 million false tax returns. If you are a victim, the IRS will contact you by mail, stating that more than one return was filed using your Social Security number. You can check the legitimacy of the mailing by calling (800) 829-1040.

If you are a victim, contact the IRS, your banks and credit card companies and report the fraud.